Bank of New York

Navigate firm data through the following pages:

| Analyst Listing | Primary Input Data |

| Derived Input Data | Valuation Model Outcomes |

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Credit Suisse | Ashley Serrao | ashley.serrao@credit-suisse.com |

| Deutsche Bank Research | Brian Bedell | brian.bedell@db.com |

| Keefe Bruyette & Woods | Brian Kleinhanzl | bkleinhanzl@kbw.com |

| Portales Partners LLC | Charles Peabody | cwp@portalespartners.com |

| Raymond James | David Long | david.j.long@raymondjames.com |

| Morningstar | Erin Davis | erin.davis@morningstar.com |

| RBC Capital Markets | Gerard Cassidy | gerard.cassidy@rbccm.com |

| Evercore ISI | Glenn Schorr | glenn.schorr@evercoreisi.com |

| Buckingham Research | James Mitchell | jmitchell@buckresearch.com |

| Sandler O’Neill & Partners | Jeffery J. Harte | jharte@sandleroneill.com |

| Jefferies | Kenneth Usdin | kusdin@jefferies.com |

| Bernstein Research | Luke Montgomery | lucas.montgomery@bernstein.com |

| Argus Research | Steve Biggar | stephen_biggar@sandp.com |

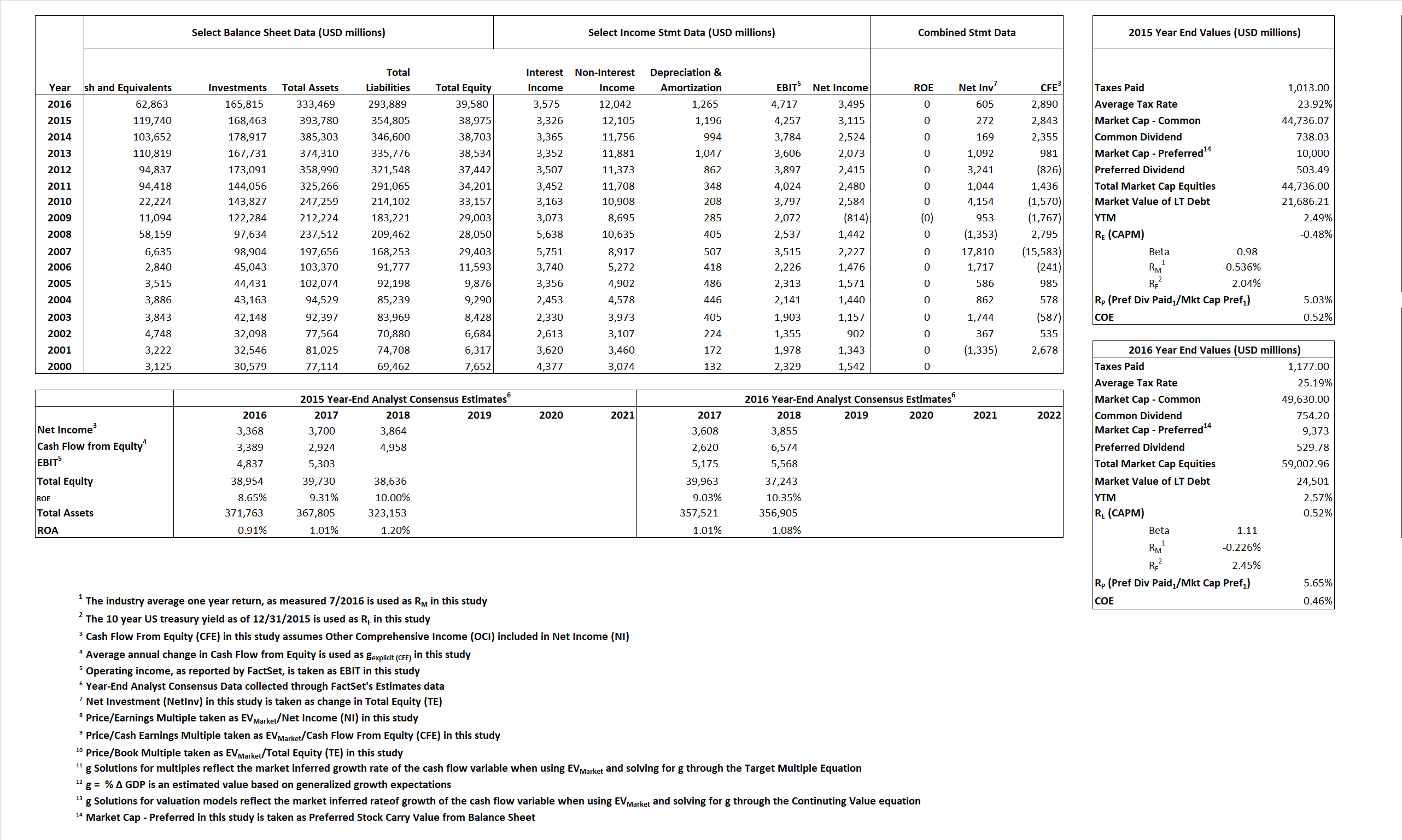

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value

|

2016 Value |

Equational Form |

| Net Income | NI | |

||

| Cash Flow From Equity | CFE | |

||

| Total Equity | TE | |

||

| Return on Equity | ROE | |

||

| Net Investment | NetInv | |

||

| Investment Rate | IR | |

||

| Cost of Equity | COE | |

||

| Enterprise value | EVMarket | |

||

| EVBook | ||||

| EV/EBIT Multiple | |

|||

| Long-Run Growth | g = % |

Long-run growth rates of the income variable (g = IR x ROIC and g = % |

||

| g = IR x ROIC |

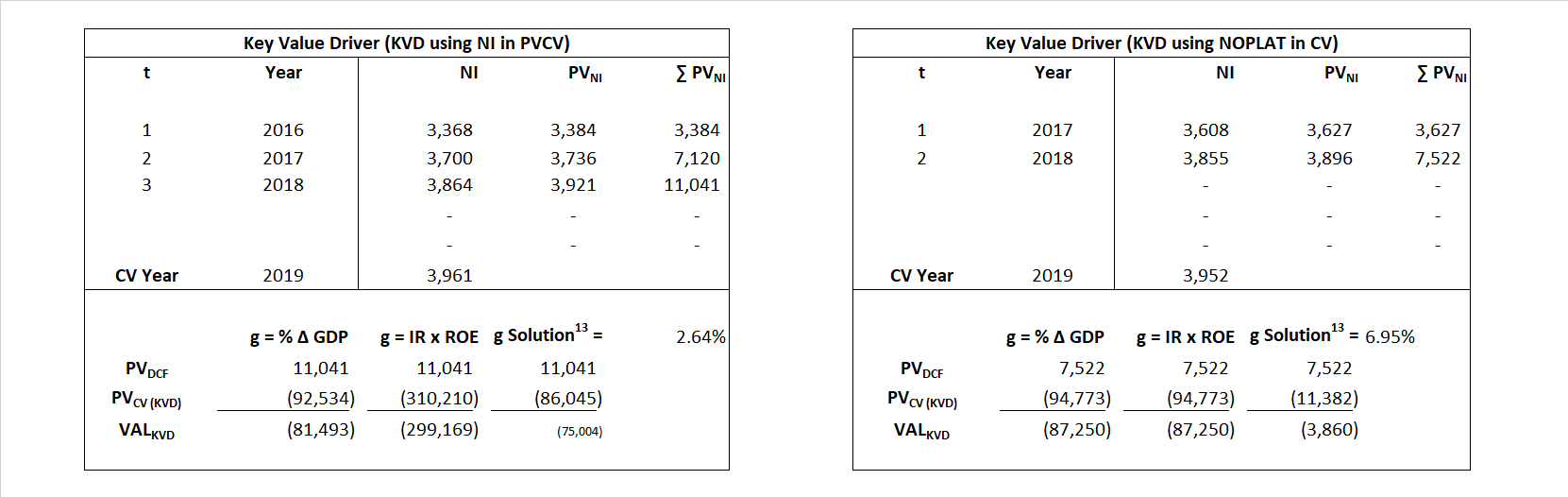

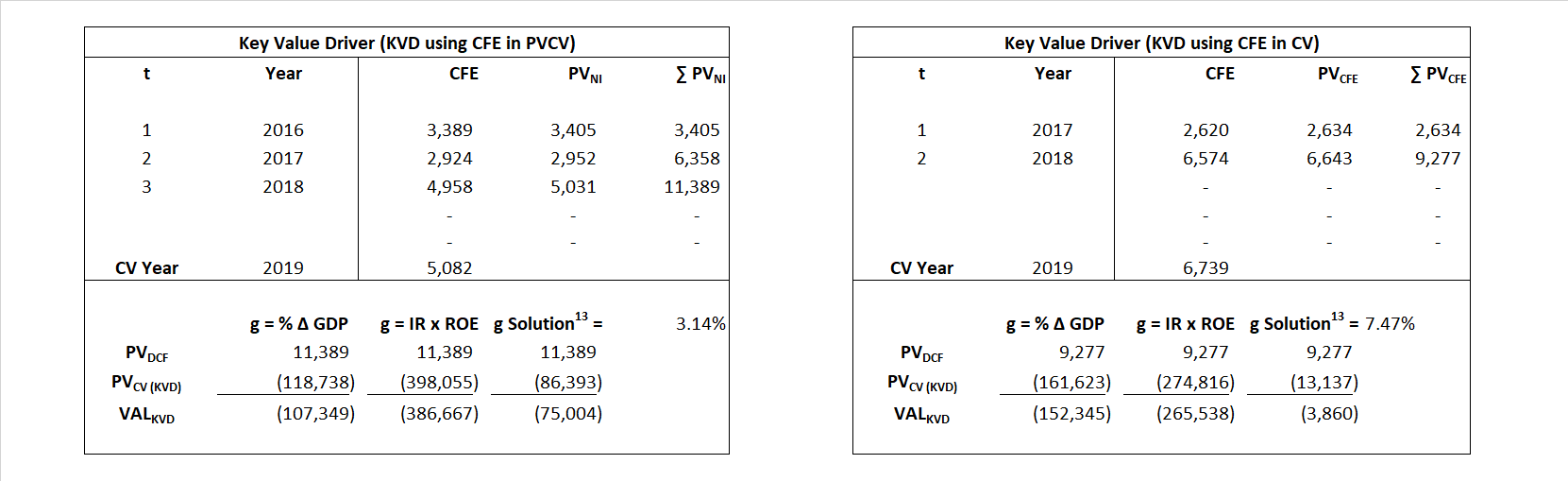

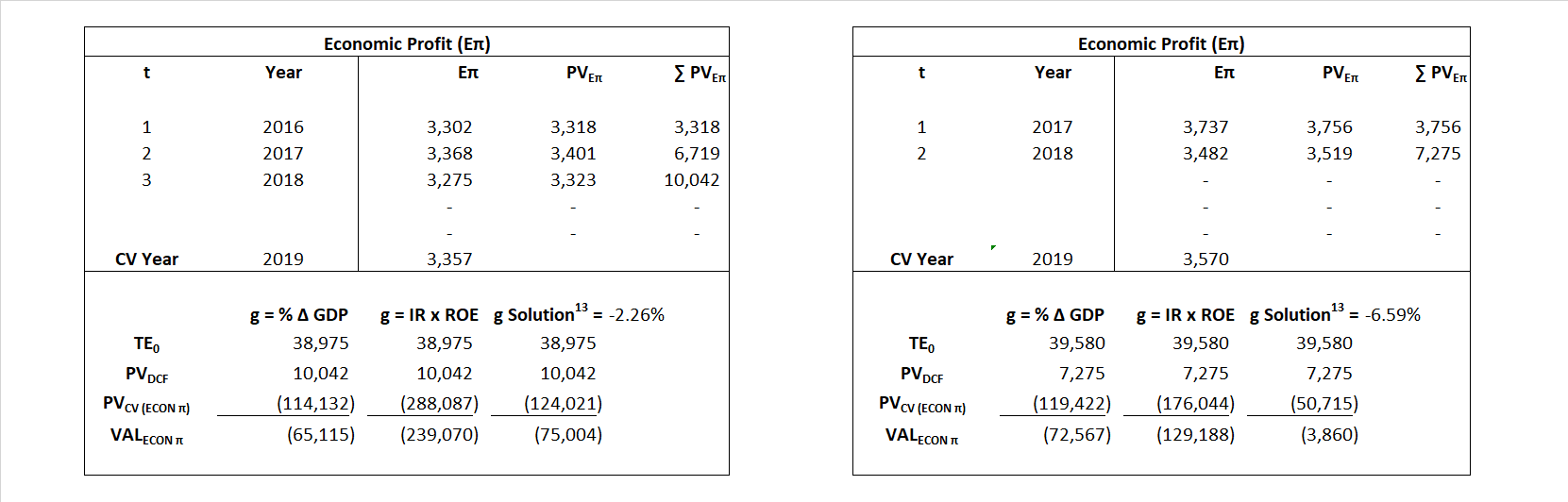

Valuation Model Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs and, depending on the equational form of any particular valuation model, may result in irrelevant or implausible results. For example, in the event WACC < g, the value of this term, often found in the denominator of an equation’s continuation value term, will be expressly negative and may result in a negative overall valuation for the firm. In the event of a WACC < g relation, the model form as applied to the subject firm offers an irrelevant outcome.

Valuation Model Type |

Label |

Equational form

|

|

| Key Value Driver (NI) | KVD (NI) | ||

|

|||

| Key Value Driver (CFE) | KVD (CFE) |

|

|

|

|||

| Cash Flow From Equity | CFE | ||

|

|||

| Economic Profit | ECON π | ||

|

|||

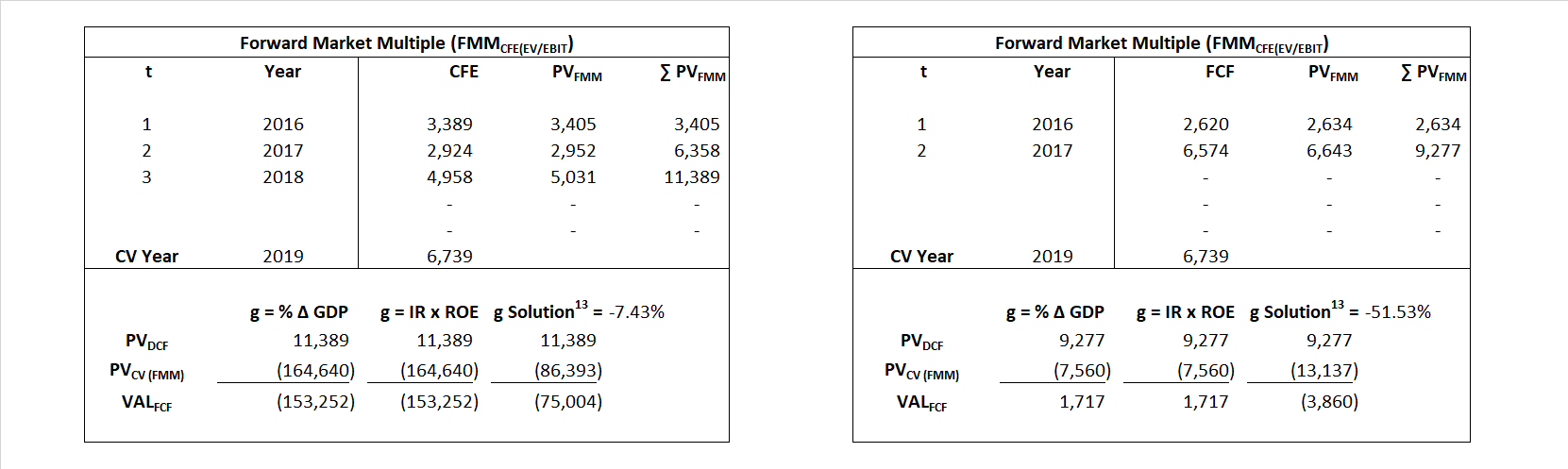

| Forward Market Multiple | FMM | ||

|

|||