Navigate firm data through the following pages:

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

Return to top of page

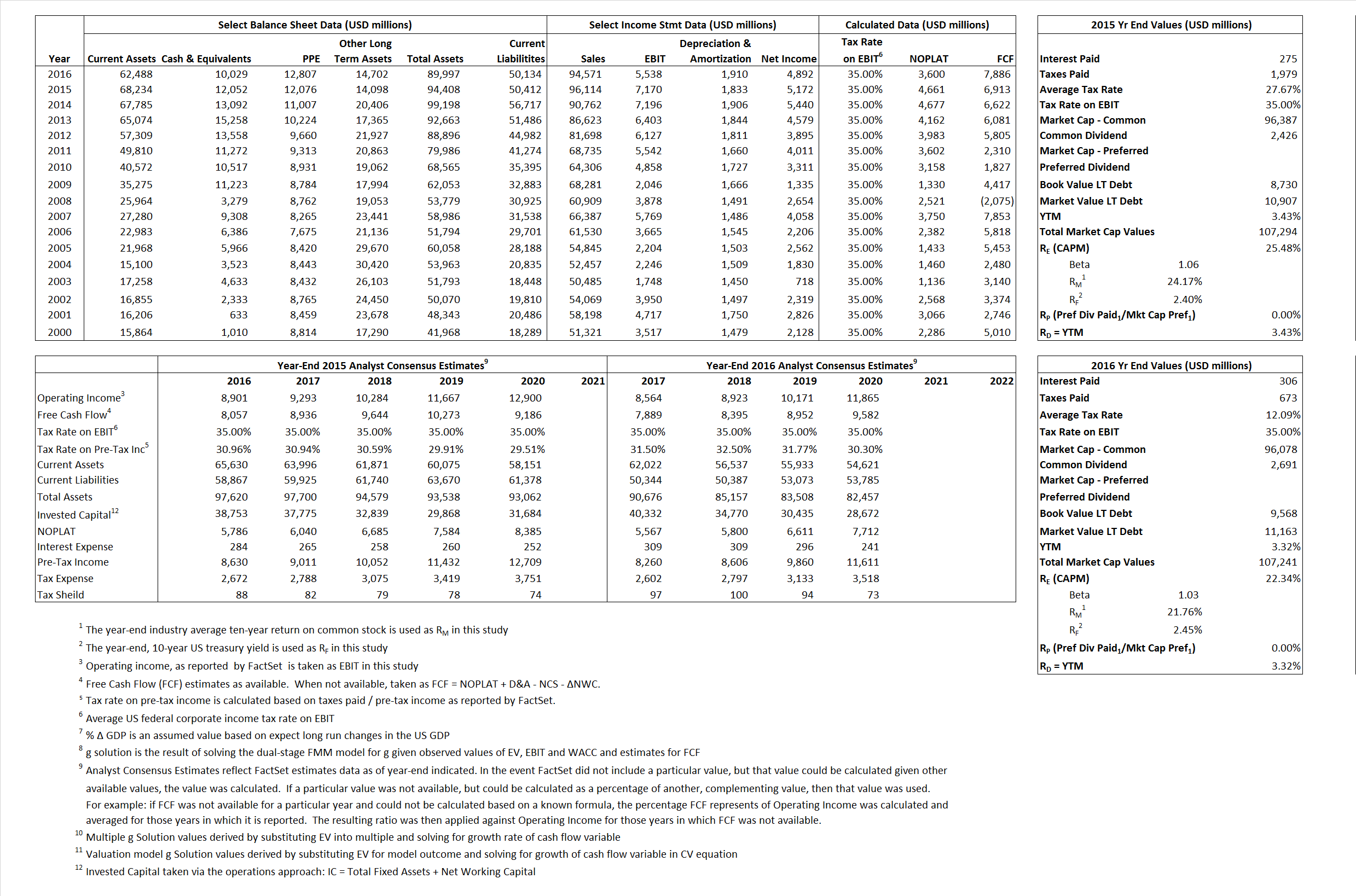

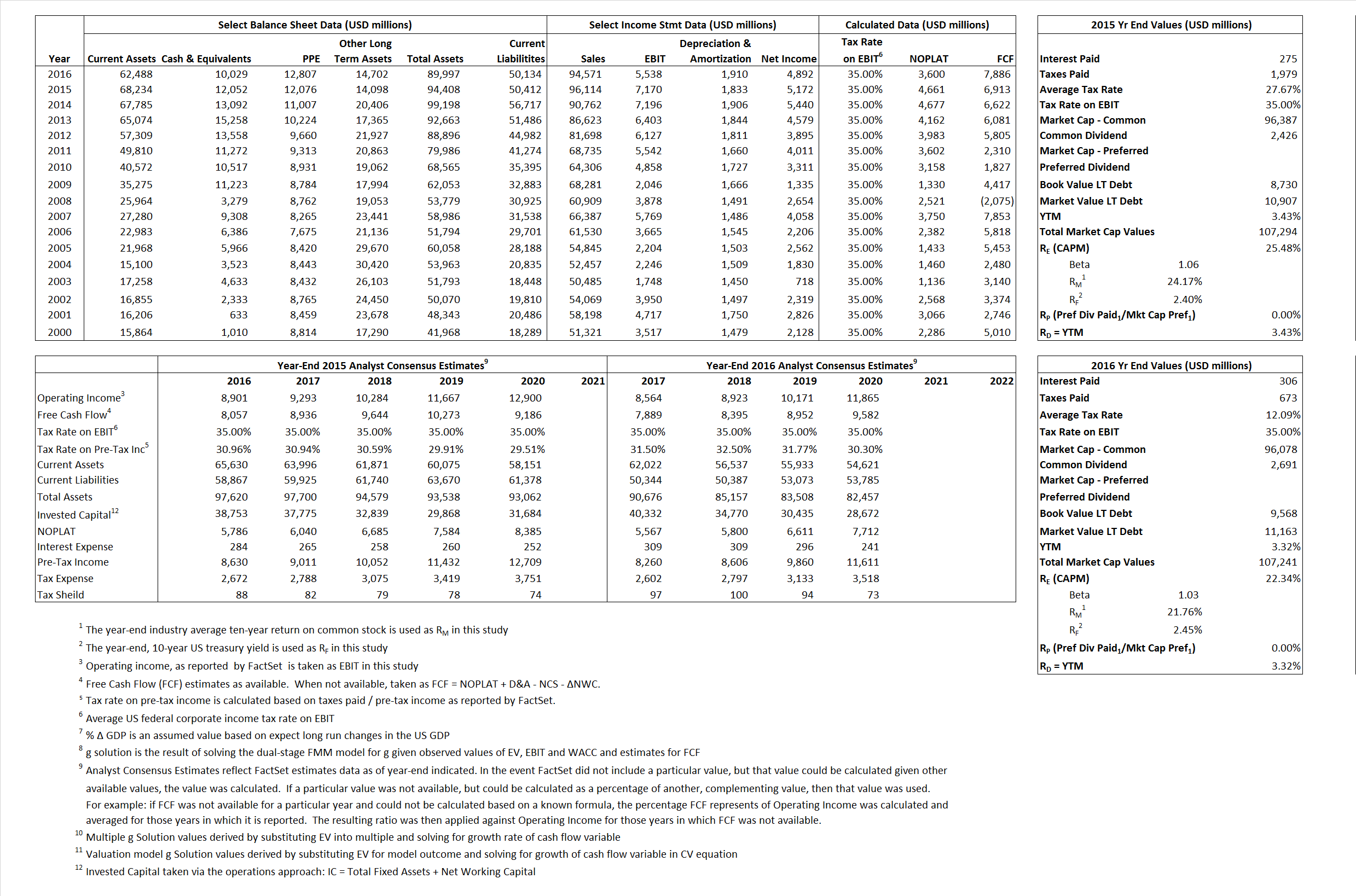

Primary Input Data

Return to top of page

Derived Input Data

Derived Input

|

Label

|

2015 Value

|

2016 Value

|

Equational Form

|

| Net Operating Profit Less Adjusted Taxes |

NOPLAT |

4,661 |

3,600 |

|

| Free Cash Flow |

FCF |

6,913 |

7,886 |

|

| Tax Shield |

TS |

76 |

37 |

|

| Invested Capital |

IC |

43,996 |

39,863 |

|

| Return on Invested Capital |

ROIC |

10.59% |

9.03% |

|

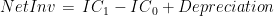

| Net Investment |

NetInv |

3,348 |

(2,223) |

|

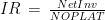

| Investment Rate |

IR |

71.84% |

-61.76% |

|

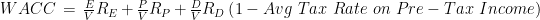

| Weighted Average Cost of Capital |

WACCMarket |

23.14% |

20.32% |

|

| WACCBook |

9.07% |

8.54% |

| Enterprise value |

EVMarket |

95,242 |

97,212 |

|

|

EVBook |

93,065 |

95,617 |

| EV/EBIT Multiple |

|

13.28 |

17.55 |

|

| Long-Run Growth |

g = IR x ROIC

|

7.61% |

-5.58% |

Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

g = %  GDP GDP |

2.50% |

2.50% |

Return to top of page

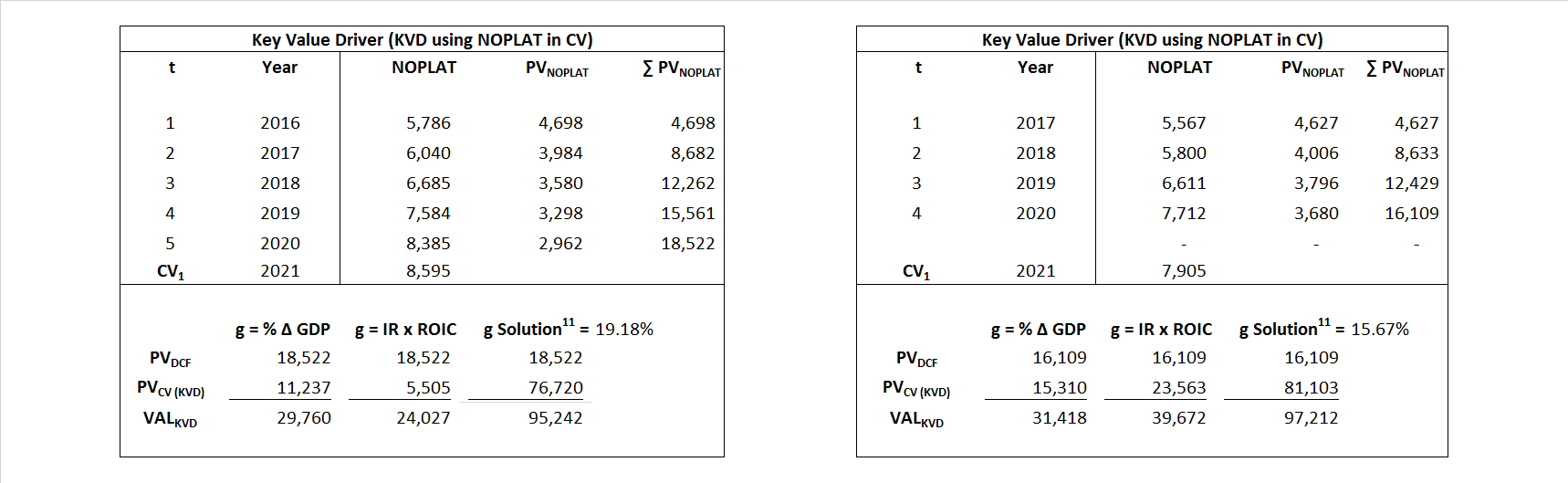

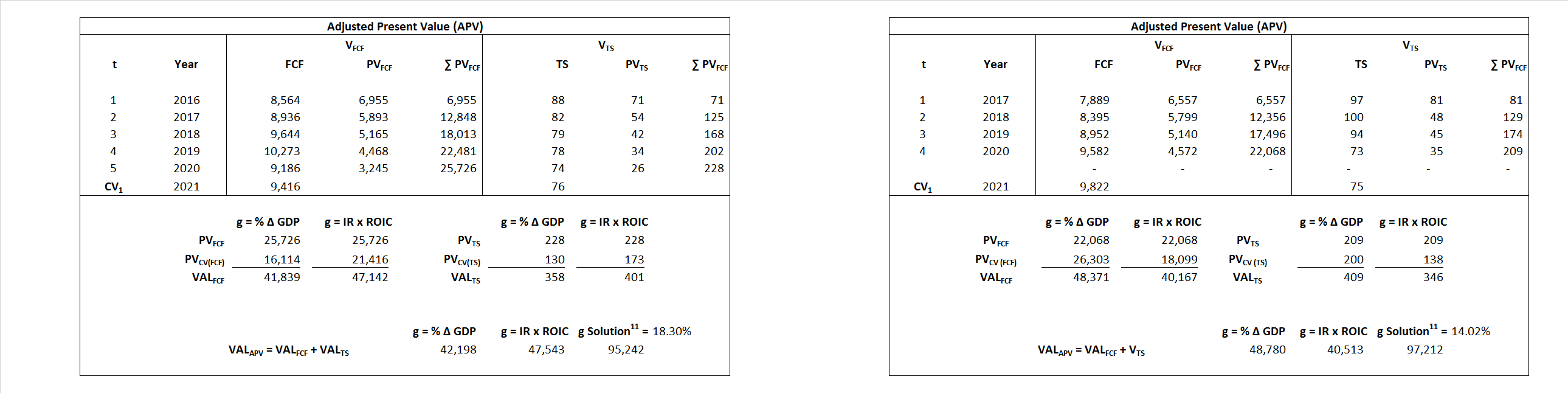

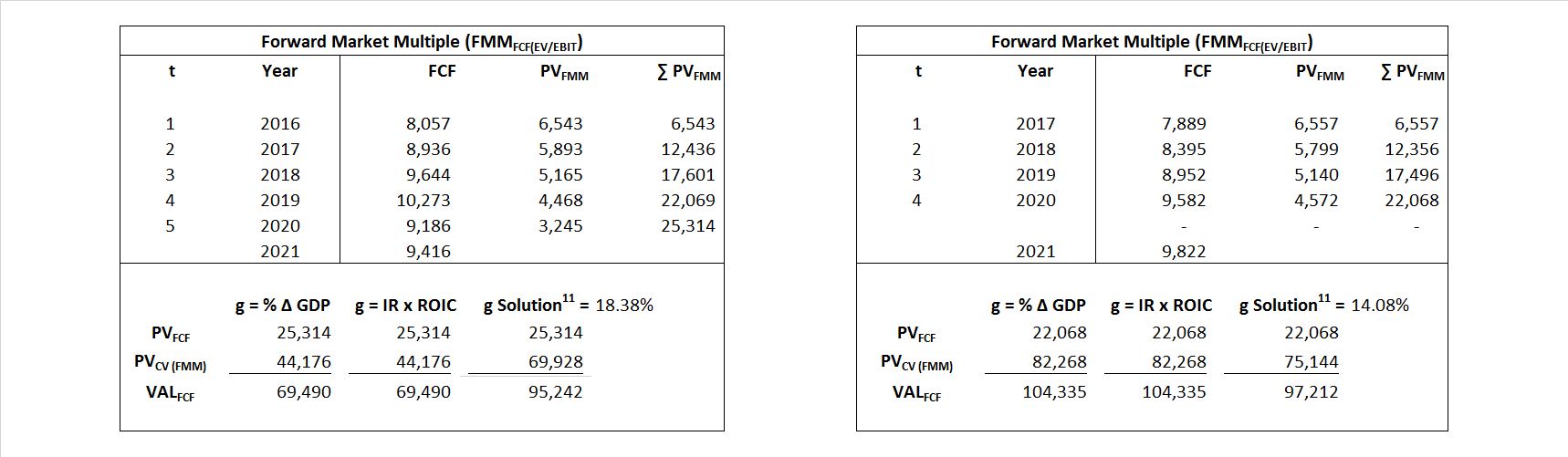

Valuation Model Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs and, depending on the equational form of any particular valuation model, may result in irrelevant or implausible results. For example, in the event WACC < g, the value of this term, often found in the denominator of an equation’s continuation value term, will be expressly negative and may result in a negative overall valuation for the firm. In the event of a WACC < g relation, the model form as applied to the subject firm offers an irrelevant outcome.

Return to top of page