Capital One

Navigate firm data through the following pages:

| Analyst Listing | Primary Input Data |

| Derived Input Data | Valuation Model Outcomes |

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Guggenheim Securities | Tony Butler | tony.butler@guggenheimpartners.com |

| Credit Suisse | Vamil Divan | vamil.divan@credit-suisse.com |

| Wells Fargo Securities | Andrew M. Casey | andrew.casey@wellsfargo.com |

| Oppenheimer | Ben Chittenden | cdonat@sandleroneill.com |

| Stifel Nicolaus | Christopher C. Brendler | ccbrendler@stifel.com |

| Sandler O’Neill & Partners | Christopher R. Donat | cdonat@sandleroneill.com |

| Drexel Hamilton | David Hilder | dhilder@drexelhamilton.com |

| Evercore ISI | David Raso | draso@isigrp.com |

| Longbow Research | Eli Lustgarten | elustgarten@longbowresearch.com |

| BMO Capital Markets | James Fotheringham | james.fotheringham@bmo.com |

| RBC Capital Markets | Jason Arnold | jason.arnold@rbccm.com |

| BMO Capital Markets | Joel Tiss | joel.tiss@bmo.com |

| Jefferies | John Hecht | jhecht@jefferies.com |

| Evercore ISI | John Pancari | john.pancari@evercoreisi.com |

| Bernstein Research | Kevin St. Pierre | kevin.st-pierre@bernstein.com |

| William Blair | Lawrence T. De Maria | ldemaria@williamblair.com |

| Credit Suisse | Moshe Orenbuch | moshe.orenbuch@credit-suisse.com |

| Atlantic Equities | Richard Radbourne | r.radbourne@atlantic-equities.com |

| Keefe Bruyette & Woods | Sanjay Sakhrani | ssakhrani@kbw.com |

| DA Davidson | Arren Cyganovich | acyganovich@dadco.com |

| Oppenheimer | Ben Chittenden | benjamin.chittenden@opco.com |

| Nomura Research | Bill Carcache | bill.carcache@nomura.com |

| Drexel Hamilton | David Hilder | dhilder@drexelhamilton.com |

| Deutsche Bank Research | David Ho | david.ho@db.com |

| Guggenheim Securities | Eric Wasserstrom | eric.wasserstrom@guggenheimpartners.com |

| CRT Capital Group | Henry J. Coffey Jr. | hcoffey@sterneageecrt.com |

| RBC Capital Markets | Jason Arnold | jason.arnold@rbccm.com |

| Wells Fargo Securities | Matthew H. Burnell | matt.burnell@wellsfargo.com |

| William Blair | Robert Napoli | bnapoli@williamblair.com |

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value

|

2016 Value |

Equational Form |

| Net Income | NI | |

||

| Cash Flow From Equity | CFE | |

||

| Total Equity | TE | |

||

| Return on Equity | ROE | |

||

| Net Investment | NetInv | |

||

| Investment Rate | IR | |

||

| Cost of Equity | COE | |

||

| Enterprise value | EVMarket | |

||

| EVBook | ||||

| EV/EBIT Multiple | |

|||

| Long-Run Growth | g = % |

Long-run growth rates of the income variable (g = IR x ROIC and g = % |

||

| g = IR x ROIC |

Valuation Model Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs and, depending on the equational form of any particular valuation model, may result in irrelevant or implausible results. For example, in the event WACC < g, the value of this term, often found in the denominator of an equation’s continuation value term, will be expressly negative and may result in a negative overall valuation for the firm. In the event of a WACC < g relation, the model form as applied to the subject firm offers an irrelevant outcome.

Valuation Model Type |

Label |

Equational form

|

|

| Key Value Driver (NI) | KVD (NI) | ||

|

|||

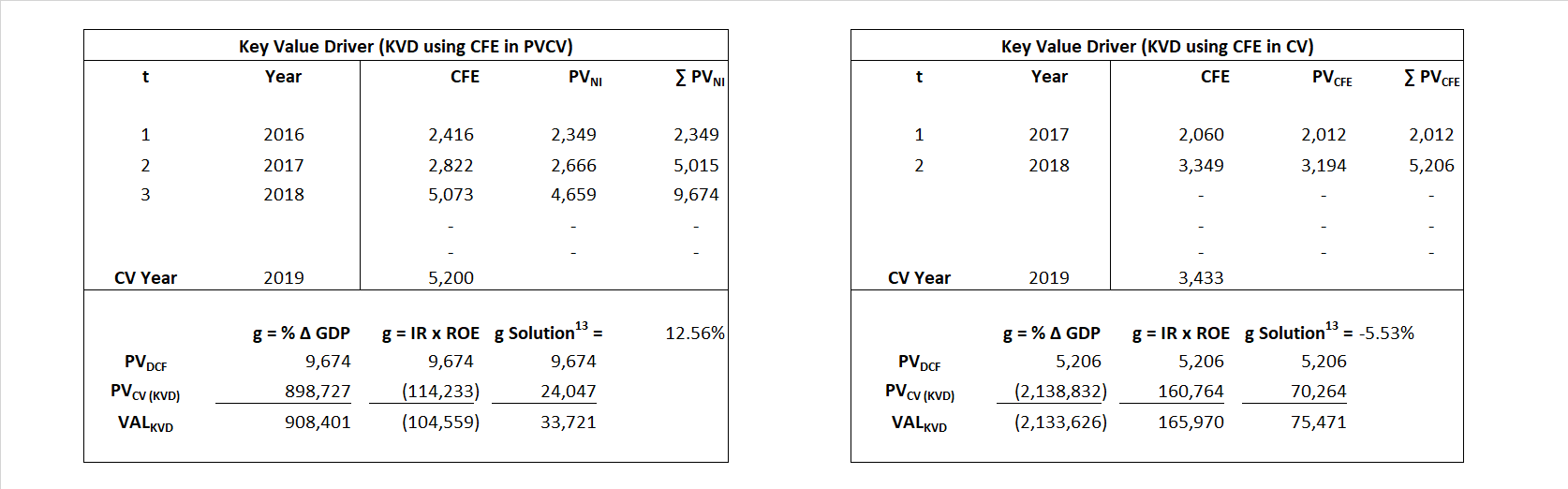

| Key Value Driver (CFE) | KVD (CFE) |

|

|

|

|||

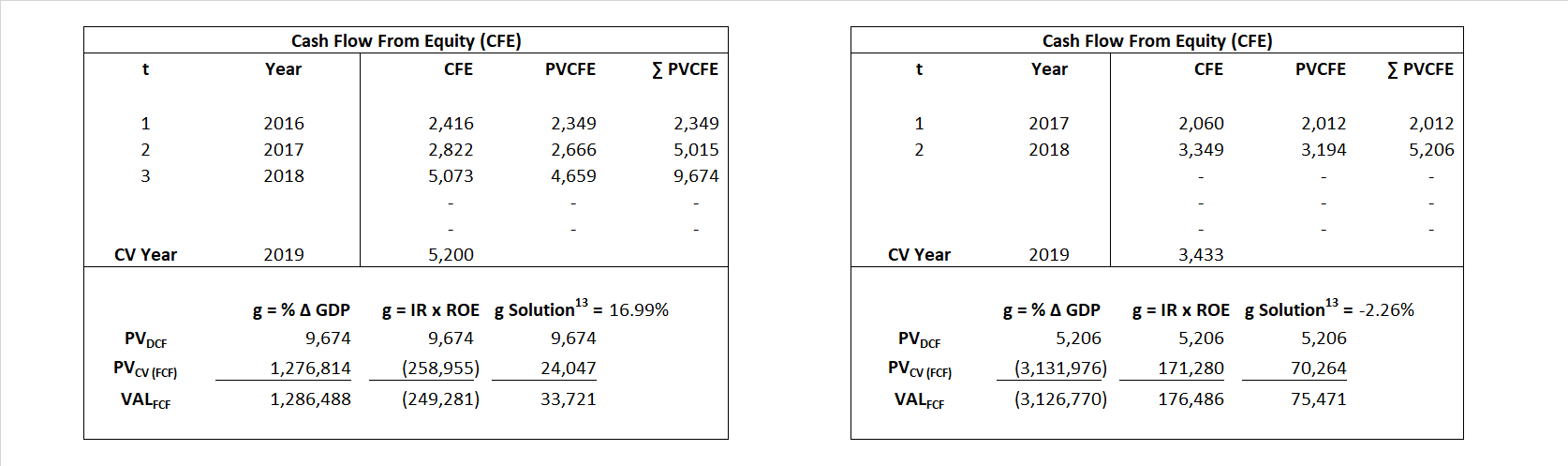

| Cash Flow From Equity | CFE | ||

|

|||

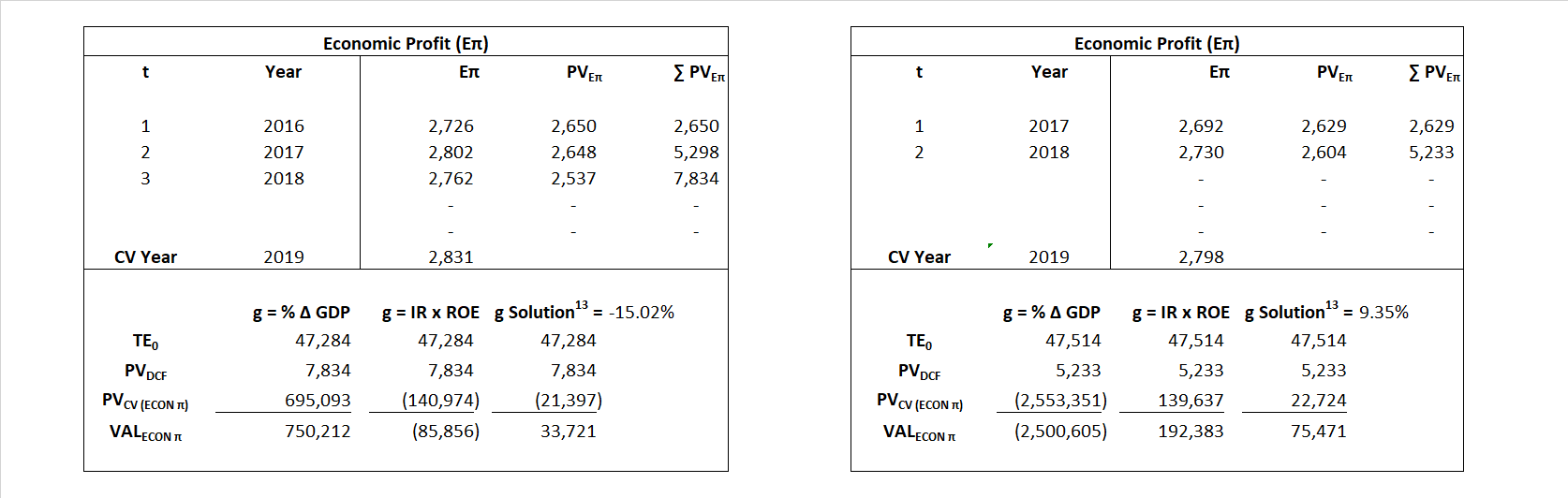

| Economic Profit | ECON π | ||

|

|||

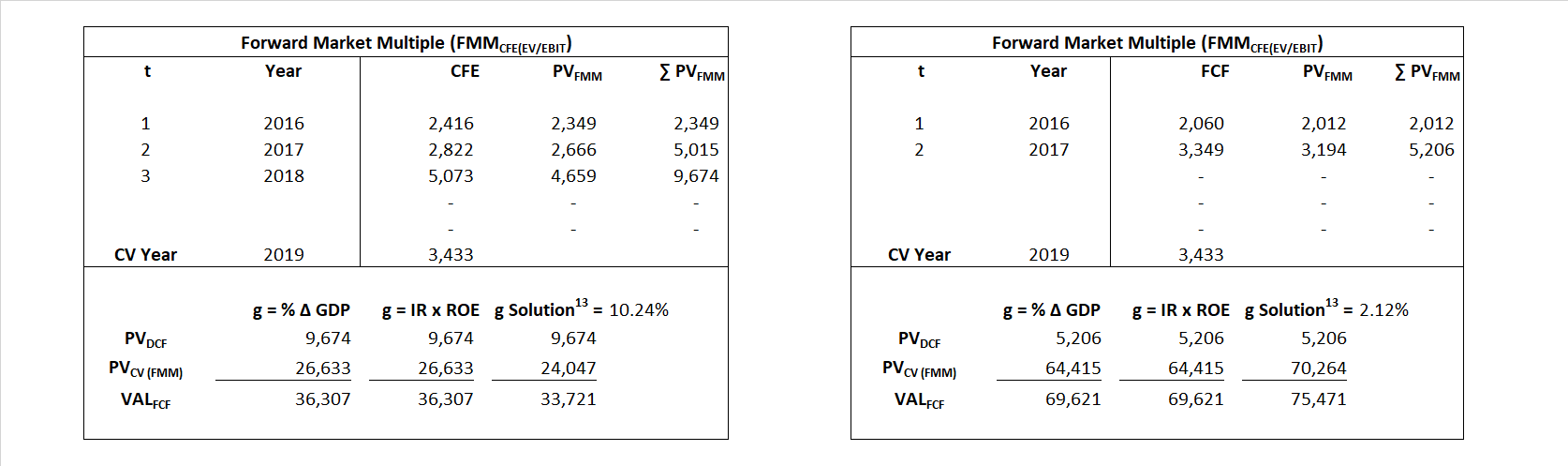

| Forward Market Multiple | FMM | ||

|

|||