Coca-Cola

Navigate firm data through the following pages:

| Analyst Listing | Primary Input Data |

| Derived Input Data | Valuation Model Outcomes |

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| William Blair | Bhavan Suri | bsuri@williamblair.com |

| Stifel Nicolaus | Brad R. Reback | rebackb@stifel.com |

| Pacific Crest Securities-KBCM | Brent Bracelin | bbracelin@pacific-crest.com |

| Drexel Hamilton | Brian J. White | bwhite@drexelhamilton.com |

| JMP Securities | Greg Mcdowell | gmcdowell@jmpsecurities.com |

| Cowen & Company | Gregg Moskowitz | gregg.moskowitz@cowen.com |

| DA Davidson | Jack Andrews | jandrews@dadco.com |

| Jefferies | John DiFucci | jdifucci@jefferies.com |

| SunTrust Robinson Humphrey | John Rizzuto | john.rizzuto@suntrust.com |

| Stephens Inc | Jonathan B. Ruykhaver | jonathan.ruykhaver@stephens.com |

| Atlantic Equities | Josep Bori | j.bori@atlantic-equities.com |

| Deutsche Bank Research | Karl Keirstead | karl.keirstead@db.com |

| BMO Capital Markets | Keith Bachman | keith.bachman@bmo.com |

| Evercore ISI | Kirk Materne | kirk.materne@evercoreisi.com |

| RBC Capital Markets | Matthew Hedberg | matthew.hedberg@rbccm.com |

| Raymond James | Michael Turits | michael.turits@raymondjames.com |

| Maxim Group | Nehal Chokshi | nehalchokshi@techinsightsresearch.com |

| Credit Suisse | Philip Winslow | philip.winslow@credit-suisse.com |

| Canaccord Genuity | Richard Davis Jr. | rdavis@canaccordgenuity.com |

| Guggenheim Securities | Ryan Hutchinson | ryan.hutchinson@guggenheimpartners.com |

| Needham | Scott Zeller | szeller@needhamco.com |

| Oppenheimer | Shaul Eyal | shaul.eyal@opco.com |

| FBN Securities | Shebly Seyrafi | sseyrafi@fbnsecurities.com |

| Mitsubishi UFJ Securities (USA) | Stephen D. Bersey | sbersey@us.sc.mufg.jp |

| Wedbush Securities | Steve Koenig | steve.koenig@wedbush.com |

| Northland Securities | Tim Klasell | tklasell@northlandcapitalmarkets.com |

| Bernstein Research | Ali Dibadj | ali.dibadj@bernstein.com |

| BMO Capital Markets | Amit Sharma | amit.sharma@bmo.com |

| Deutsche Bank Research | Bill Schmitz Jr. | william.schmitz@db.com |

| Wells Fargo Securities | Bonnie Herzog | bonnie.herzog@wellsfargo.com |

| Consumer Edge Research | Brett Cooper | bcooper@consumeredgeresearch.com |

| Jefferies | Kevin Grundy | kgrundy@jefferies.com |

| Stifel Nicolaus | Mark D. Swartzberg | mswartzberg@stifel.com |

| RBC Capital Markets | Nik Modi | nik.modi@rbccm.com |

| Susquehanna Financial Group | Pablo Zuanic | pablo.zuanic@sig.com |

| Evercore ISI | Robert Ottenstein | robert.ottenstein@evercoreisi.com |

| Cowen & Company | Vivien Azer | vivien.azer@cowen.com |

| SunTrust Robinson Humphrey | William B. Chappell Jr. | bill.chappell@suntrust.com |

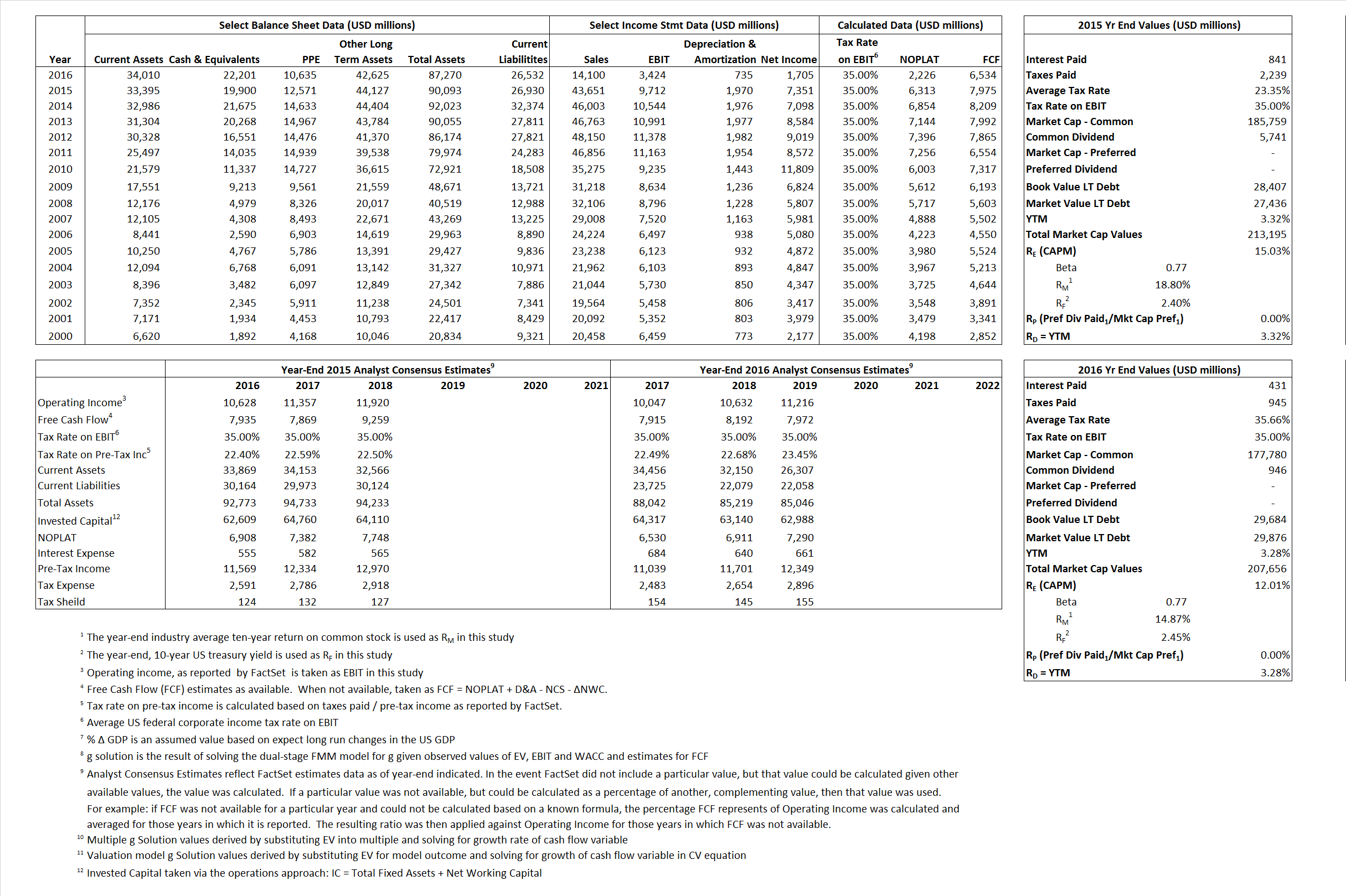

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value

|

2016 Value

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 6,313 | 2,226 | |

| Free Cash Flow | FCF | 7,975 | 6,534 | |

| Tax Shield | TS | 196 | 154 | |

| Invested Capital | IC | 63,163 | 60,738 | |

| Return on Invested Capital | ROIC | 9.99% | 3.66% | |

| Net Investment | NetInv | 5,484 | (1,690) | |

| Investment Rate | IR | 86.87% | -75.93% | |

| Weighted Average Cost of Capital | WACCMarket | 13.42% | 10.59% | |

| WACCBook | 6.60% | 6.31% | ||

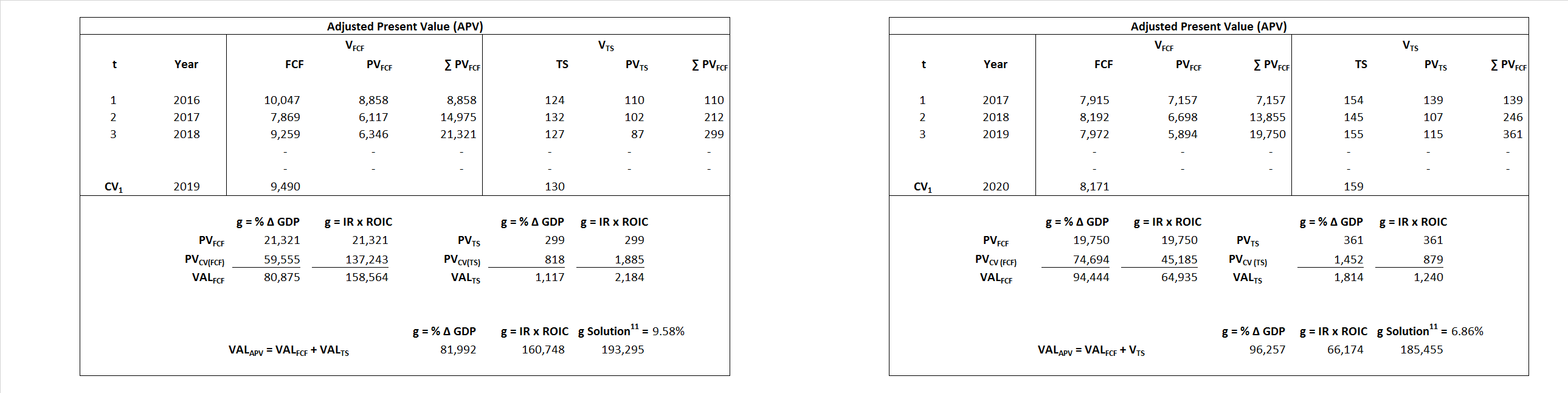

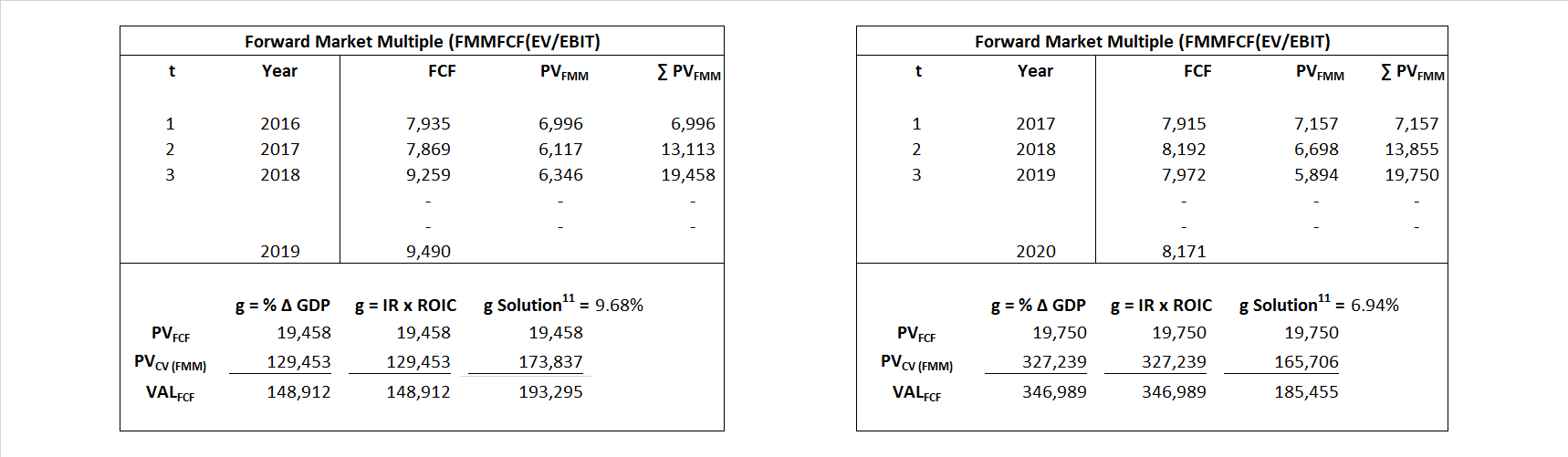

| Enterprise value | EVMarket | 193,295 | 185,455 | |

| EVBook | 191,965 | 185,263 | ||

| EV/EBIT Multiple | 19.90 | 54.16 | ||

| Long-Run Growth | g = IR x ROIC |

8.68% | -2.78% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% |

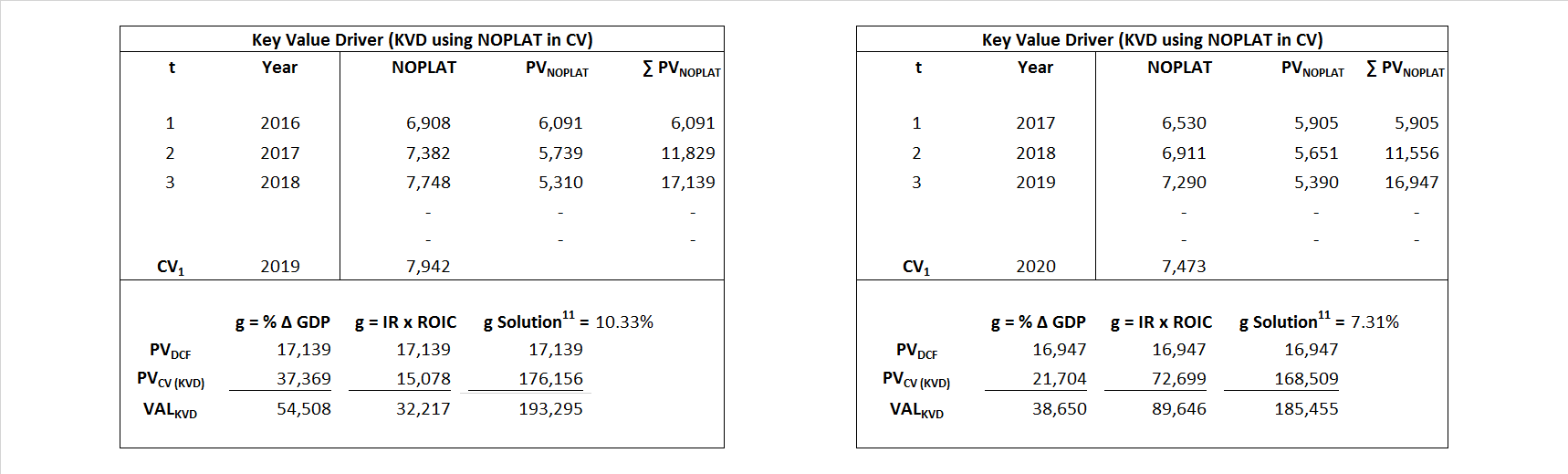

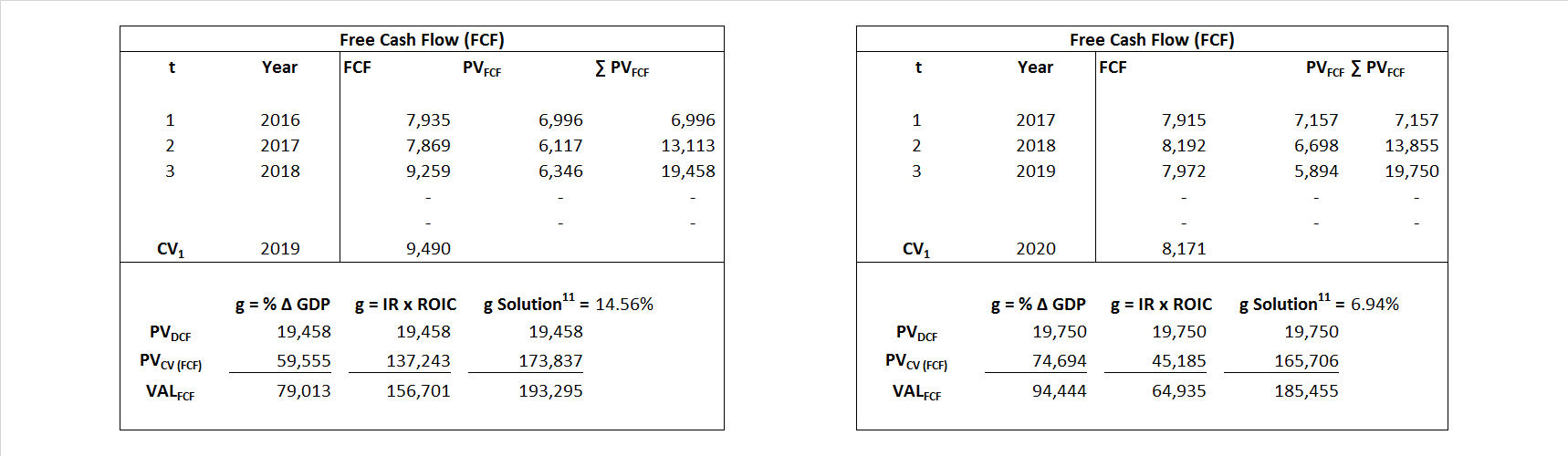

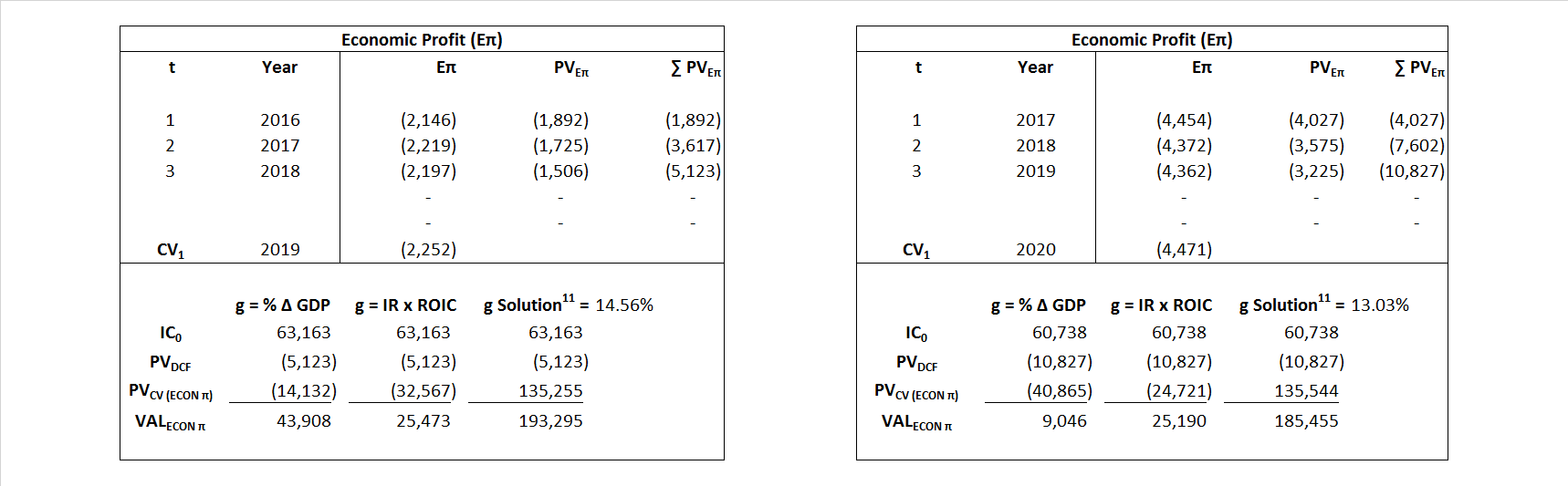

Valuation Model Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs and, depending on the equational form of any particular valuation model, may result in irrelevant or implausible results. For example, in the event WACC < g, the value of this term, often found in the denominator of an equation’s continuation value term, will be expressly negative and may result in a negative overall valuation for the firm. In the event of a WACC < g relation, the model form as applied to the subject firm offers an irrelevant outcome.

Valuation Model Type |

Label |

Equational form

|

|

| Key Value Driver (NOPLAT) | KVD (NOPLAT) | ||

|

|||

| Key Value Driver (FCF) | KVD (FCF) |

|

|

|

|||

| Free Cash Flow | FCF | ||

|

|||

| Economic Profit | ECON π | ||

|

|||

| Adjusted Present Value | APV | ||

|

|||

| Forward Market Multiple | FMM | ||

|

|||