Devon Energy

Navigate firm data through the following pages:

| Analyst Listing | Primary Input Data |

| Derived Input Data | Valuation Model Outcomes |

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Stephens Inc | Ben Wyatt | ben.wyatt@stephens.com |

| Susquehanna Financial Group | Biju Perincheril | biju.perincheril@sig.com |

| Johnson Rice & Company | Charles Meade | cmeade@jrco.com |

| Cowen & Company | Charles Robertson | charles.robertson@cowen.com |

| Piper Jaffray | David Kistler | david.w.kistler@simmonspjc.com |

| Wells Fargo Securities | David Tameron | david.tameron@wellsfargo.com |

| GMP Securities | Derrick Whitfield | dwhitfield@gmpsecurities.com |

| Credit Suisse | Edward Westlake | edward.westlake@credit-suisse.com |

| IBERIA Capital Partners | Eric Fox | eric.fox@iberiabank.com |

| Alembic Global Advisors | James Sullivan | james.sullivan@alembicglobal.com |

| KLR Group | John Gerdes | jjg@klrgroup.com |

| Jefferies | Jonathan D. Wolff | jwolff@jefferies.com |

| Raymond James | Kevin Smith | kevin.smith@raymondjames.com |

| Nomura Research | Lloyd Byrne | lloyd.byrne@nomura.com |

| Seaport Global Securities | Michael Kelly | mkelly@seaportglobal.com |

| Mitsubishi UFJ Securities (USA) | Michael McAllister | mmcallister@us.sc.mufg.jp |

| Wolfe Research | Paul Sankey | psankey@wolferesearch.com |

| Scotia Howard Weil | Peter Kissel | peter.kissel@scotiabank.com |

| BMO Capital Markets | Phillip Jungwirth | phillip.jungwirth@bmo.com |

| Capital One Securities | Phillips Johnston | phillips.johnston@capitalone.com |

| Deutsche Bank Research | Ryan Todd | ryan.todd@db.com |

| RBC Capital Markets | Scott Hanold | scott.hanold@rbccm.com |

| Evercore ISI | Stephen Richardson | stephen.richardson@evercoreisi.com |

| Guggenheim Securities | Subash Chandra | subash.chandra@guggenheimpartners.com |

| Wunderlich Securities | Vedran Vuk | vedranvuk@wundernet.com |

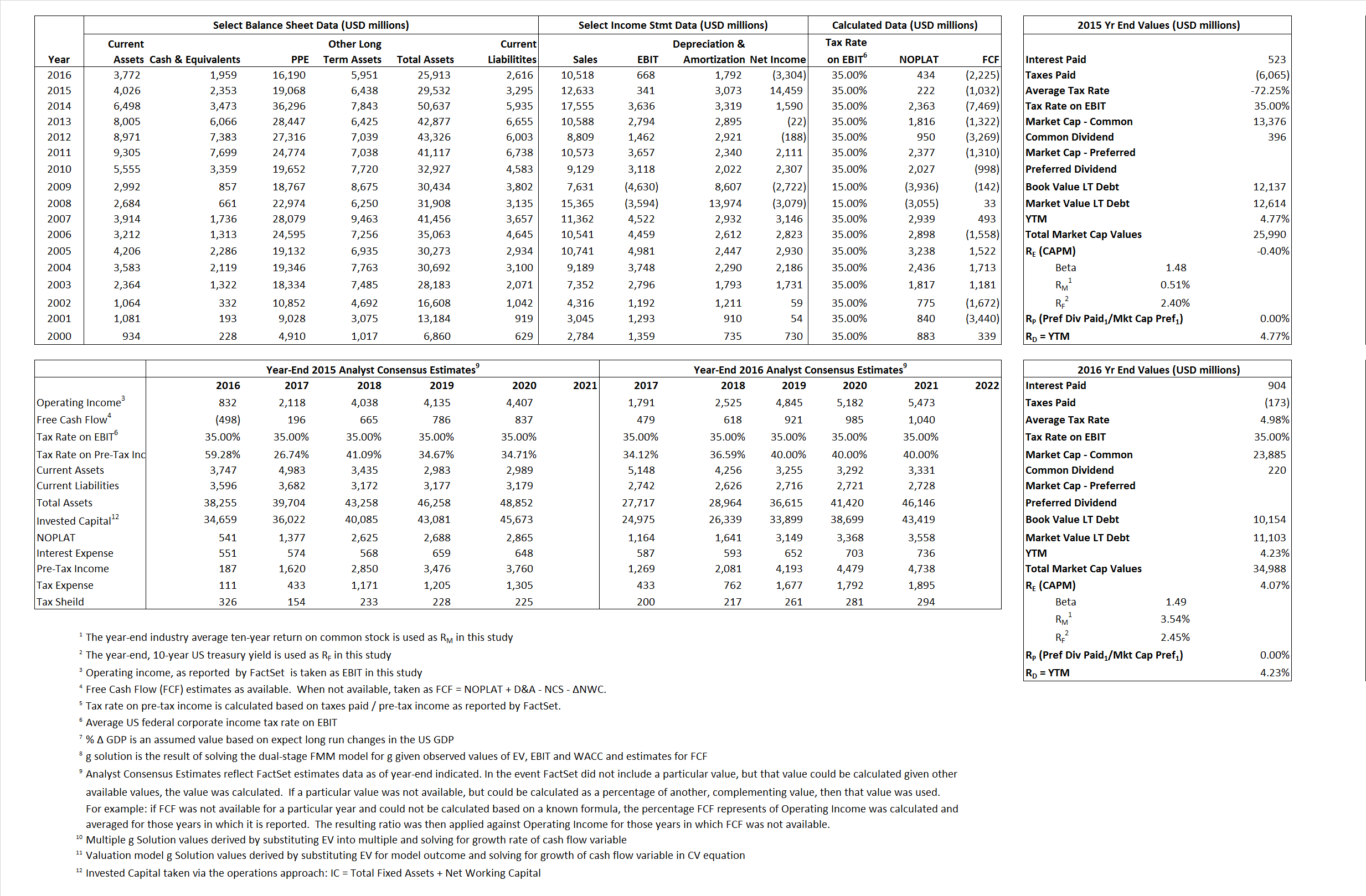

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value

|

2016 Value

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | |||

| Free Cash Flow | FCF | |||

| Tax Shield | TS | |||

| Invested Capital | IC | |||

| Return on Invested Capital | ROIC | |||

| Net Investment | NetInv | |||

| Investment Rate | IR | |||

| Weighted Average Cost of Capital | WACCMarket | |||

| WACCBook | ||||

| Enterprise value | EVMarket | |

||

| EVBook | ||||

| EV/EBIT Multiple | ||||

| Long-Run Growth | g = IR x ROIC |

Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. | ||

| g = % |

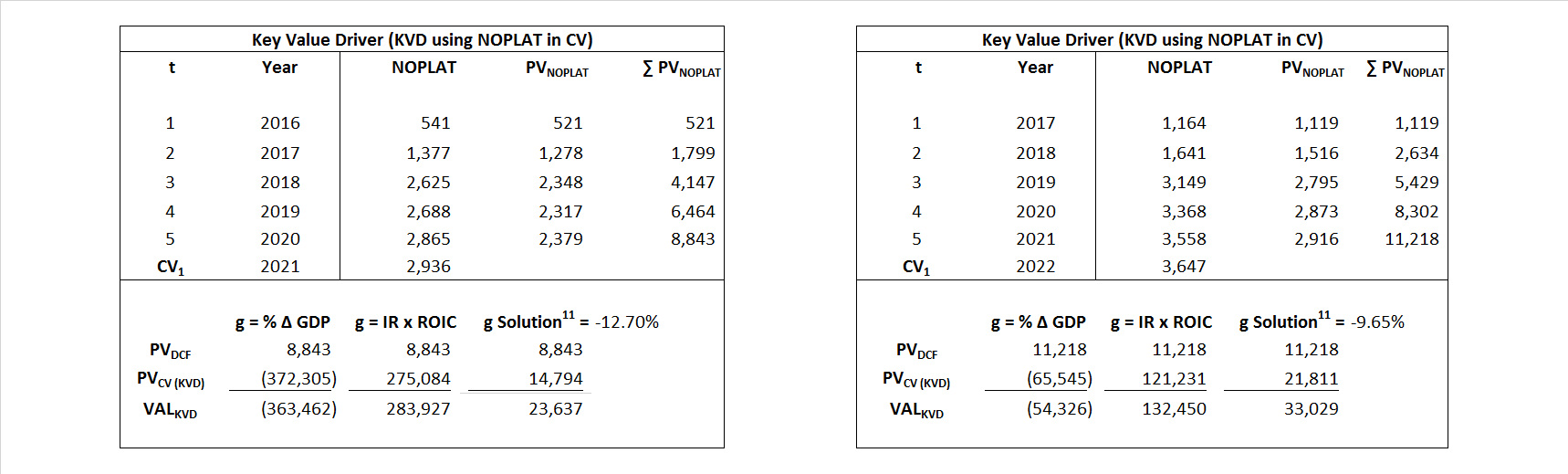

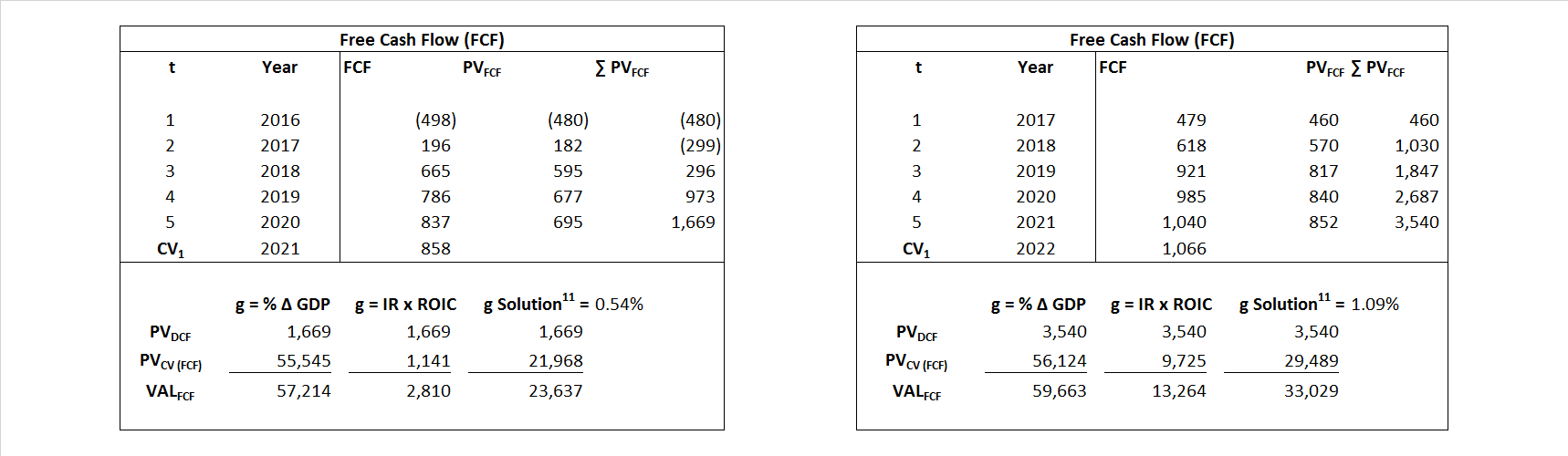

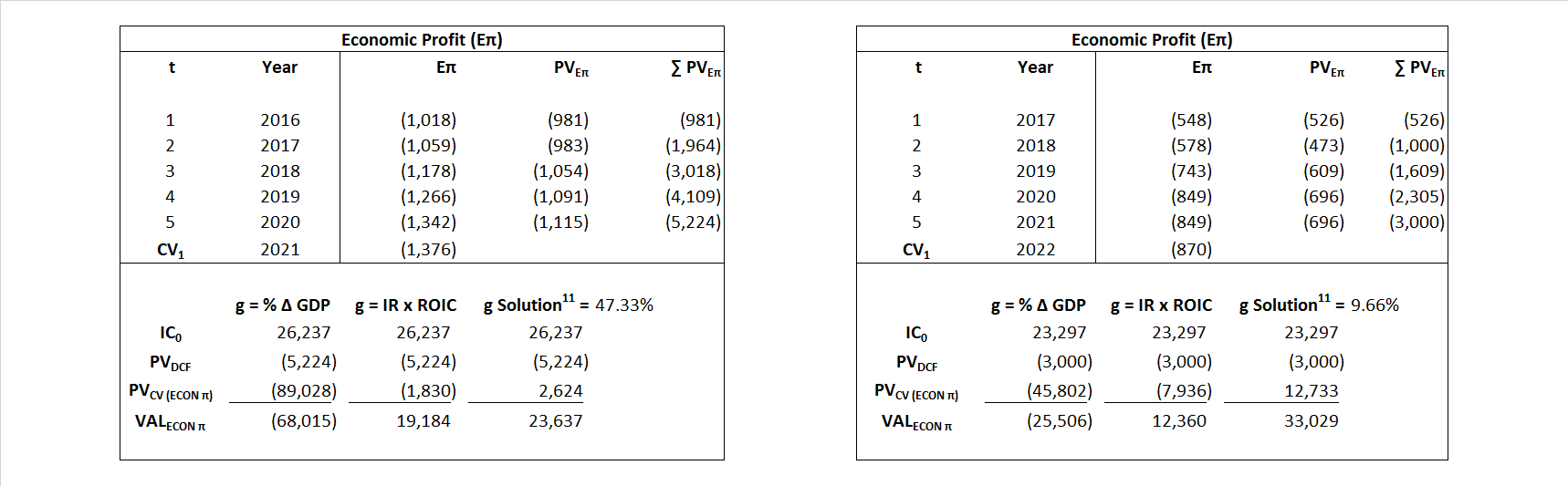

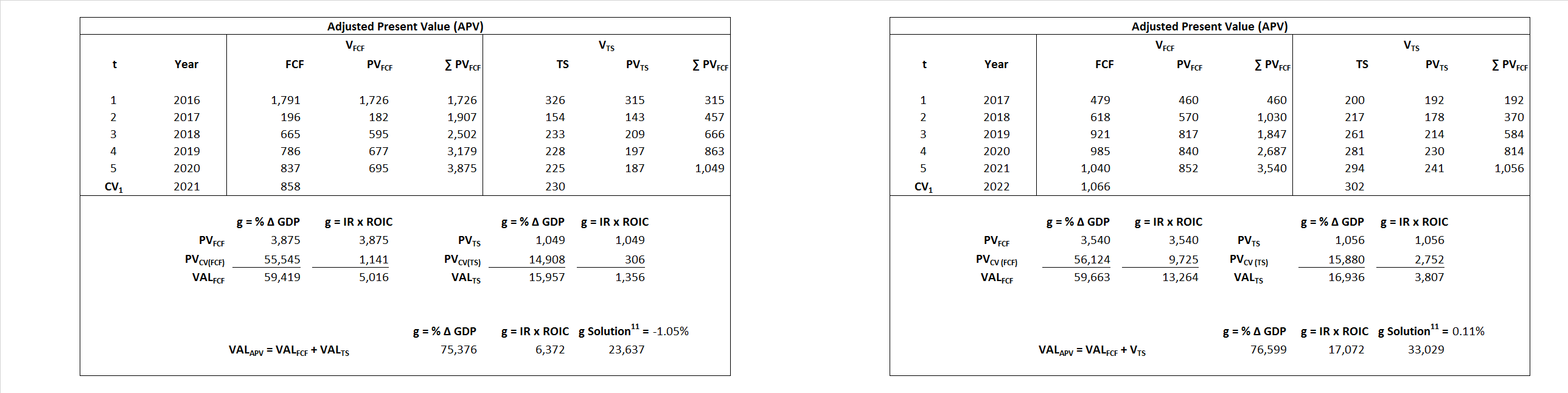

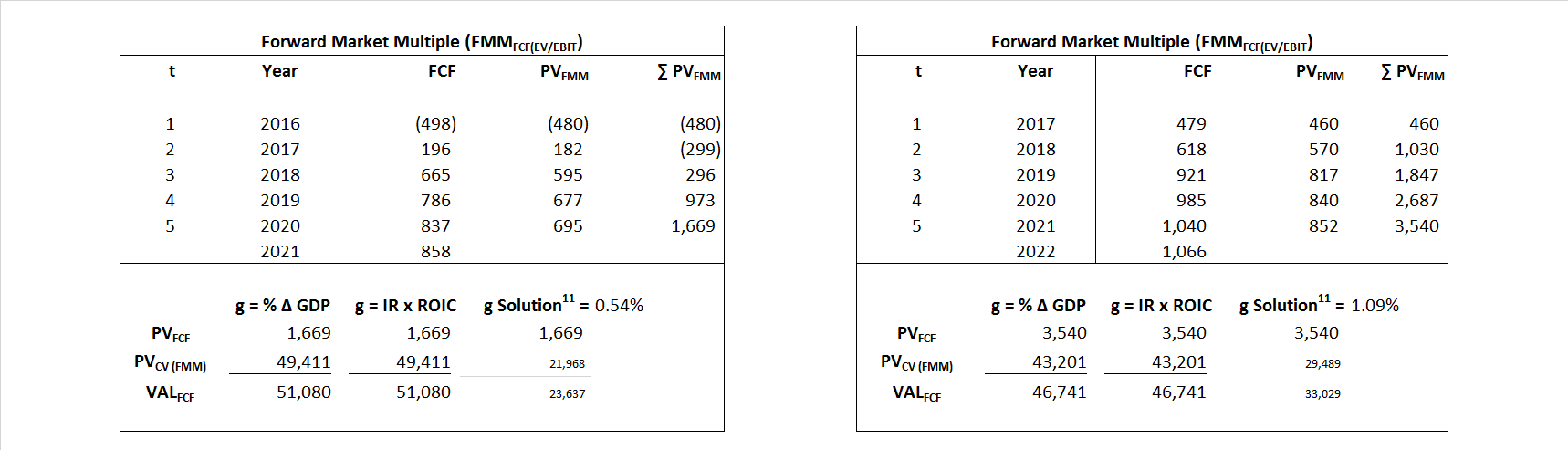

Valuation Model Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs and, depending on the equational form of any particular valuation model, may result in irrelevant or implausible results. For example, in the event WACC < g, the value of this term, often found in the denominator of an equation’s continuation value term, will be expressly negative and may result in a negative overall valuation for the firm. In the event of a WACC < g relation, the model form as applied to the subject firm offers an irrelevant outcome.

Valuation Model Type |

Label |

Equational form

|

|

| Key Value Driver (NOPLAT) | KVD (NOPLAT) | ||

|

|||

| Key Value Driver (FCF) | KVD (FCF) |

|

|

|

|||

| Free Cash Flow | FCF | ||

|

|||

| Economic Profit | ECON π | ||

|

|||

| Adjusted Present Value | APV | ||

|

|||

| Forward Market Multiple | FMM | ||

|

|||