National Oilwell Varco

Navigate firm data through the following pages:

| Analyst Listing | Primary Input Data |

| Derived Input Data | Valuation Model Outcomes |

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Piper Jaffray | Bill Herbert | william.a.herbert@simmonspjc.com |

| Scotia Howard Weil | Bill Sanchez | william.sanchez@scotiabank.com |

| Jefferies | Brad Handler | brad.handler@jefferies.com |

| William Blair | Brandon Dobell | bdobell@williamblair.com |

| GMP Securities | Brian Uhlmer | buhlmer@gmpsecurities.com |

| Tudor Pickering Holt & Co. | Byron K. Pope | bpope@tudorpickering.com |

| Susquehanna Financial Group | Charles Minervino | charles.minervino@sig.com |

| BMO Capital Markets | Daniel Boyd | daniel.boyd@bmo.com |

| KLR Group | Darren Gacicia | dfg@klrgroup.com |

| Societe Generale | Edward Muztafago | edward.muztafago@sgcib.com |

| Raymond James | J .Marshall Adkins | marshall.adkins@raymondjames.com |

| Evercore ISI | James West | james.west@evercoreisi.com |

| Credit Suisse | James Wicklund | james.wicklund@credit-suisse.com |

| Capital One Securities | Joseph D. Gibney | joseph.gibney@capitalone.com |

| Wells Fargo Securities | Judson E. Bailey | jud.bailey@wellsfargo.com |

| Seaport Global Securities | Ken Sill | ksill@seaportglobal.com |

| Griffin Securities | Kevin Simpson | ksimpson@griffinsecurities.com |

| RBC Capital Markets | Kurt Hallead | kurt.hallead@rbccm.com |

| Cowen & Company | Marc Bianchi | marc.bianchi@cowen.com |

| Johnson Rice & Company | Martin W. Malloy | mmalloy@jrco.com |

| Nomura Research | Matthew Johnston | matthew.johnston@nomura.com |

| Guggenheim Securities | Michael LaMotte | michael.lamotte@guggenheimpartners.com |

| Clarksons Platou Securities | Nokta Haithum | haithum.nokta@clarksons.com |

| KeyBanc Capital Markets | Robin Shoemaker | robin_shoemaker@key.com |

| FBR Capital Markets & Co | Thomas Curran | tcurran@fbr.com |

| IBERIA Capital Partners | Trey Stolz | trey.stolz@iberiabank.com |

| Fearnley Securities | Truls Olsen | t.olsen@fearnleys.no |

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value

|

2016 Value

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 1,242 | (187) | |

| Free Cash Flow | FCF | 879 | 676 | |

| Tax Shield | TS | (31) | 1 | |

| Invested Capital | IC | 22,476 | 18,093 | |

| Return on Invested Capital | ROIC | 5.52% | -1.03% | |

| Net Investment | NetInv | (2,965) | (3,680) | |

| Investment Rate | IR | -238.82% | 1967.91% | |

| Weighted Average Cost of Capital | WACCMarket | 2.34% | 2.87% | |

| WACCBook | 8.55% | 8.59% | ||

| Enterprise value | EVMarket | 13,178 | 15,431 | |

| EVBook | 15,104 | 15,476 | ||

| EV/EBIT Multiple | 6.90 | (70.14) | ||

| Long-Run Growth | g = IR x ROIC |

-13.19% | -20.34% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% |

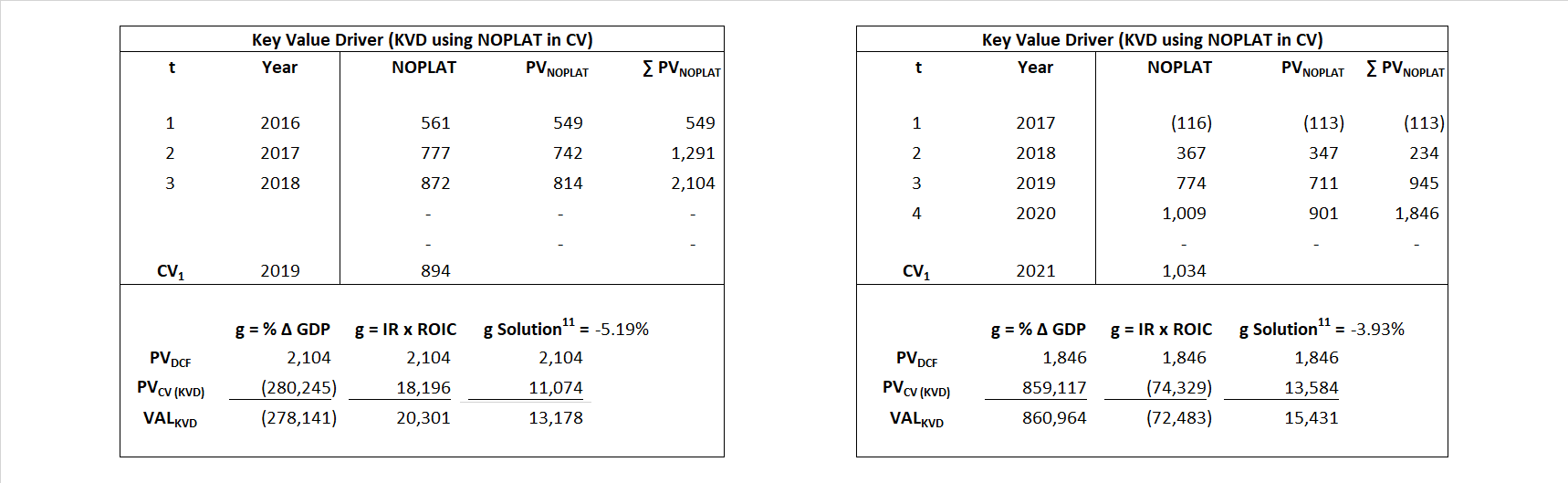

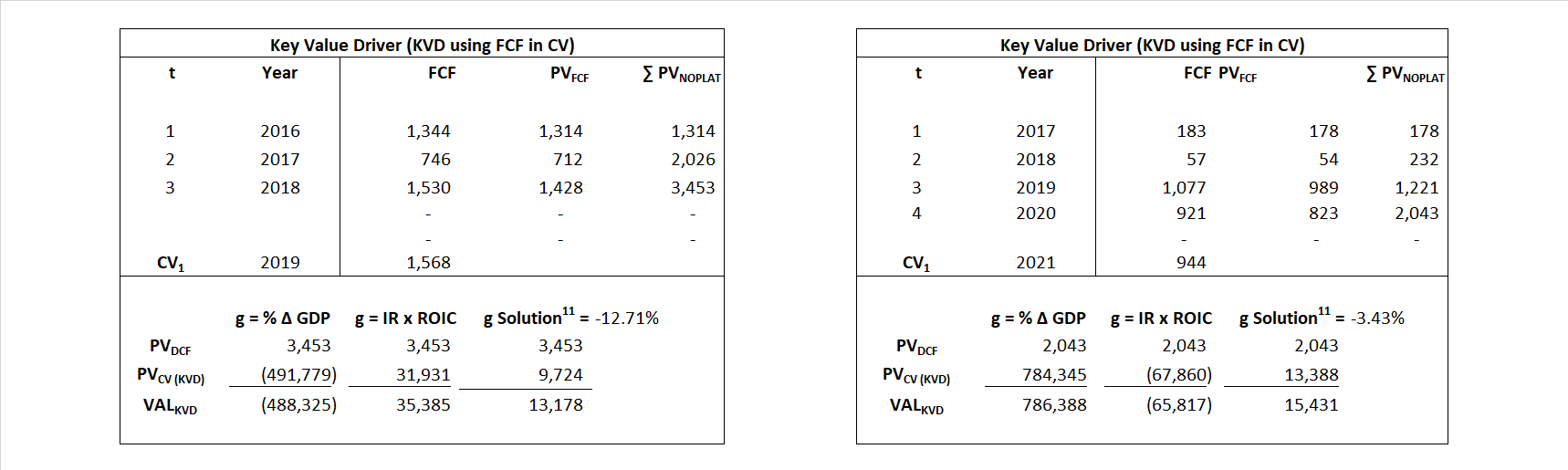

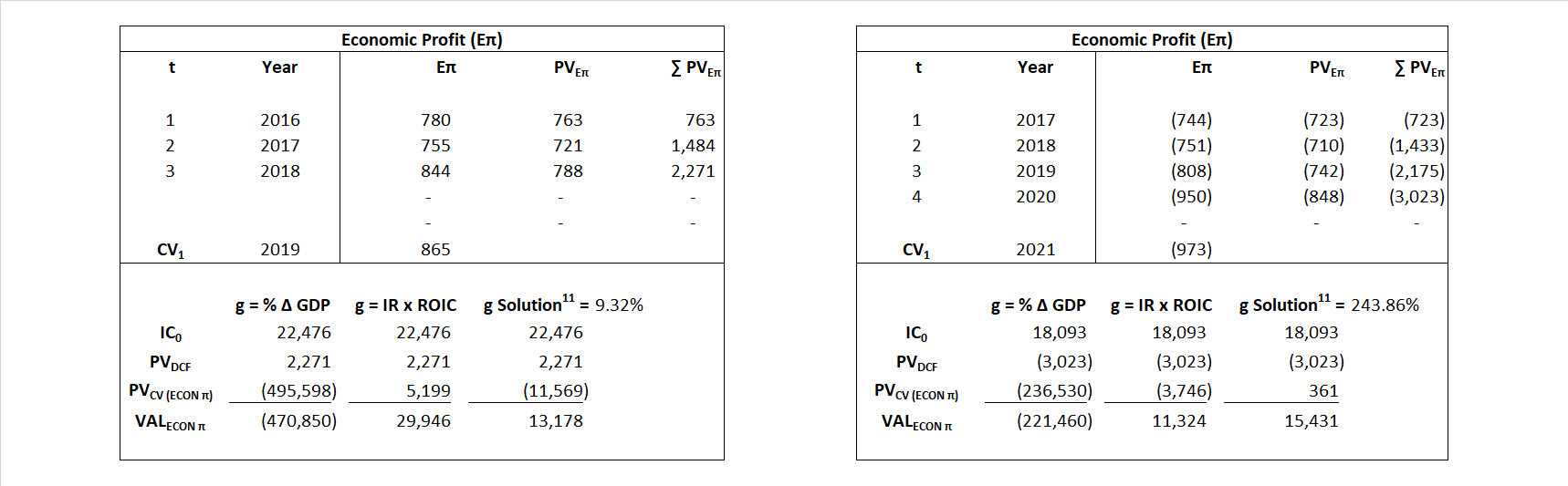

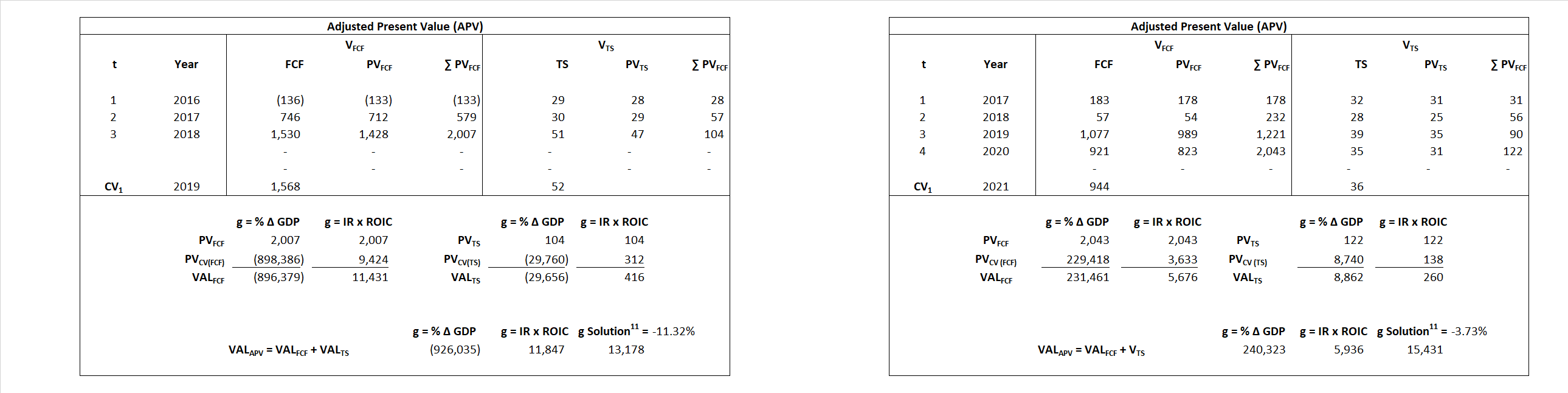

Valuation Model Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs and, depending on the equational form of any particular valuation model, may result in irrelevant or implausible results. For example, in the event WACC < g, the value of this term, often found in the denominator of an equation’s continuation value term, will be expressly negative and may result in a negative overall valuation for the firm. In the event of a WACC < g relation, the model form as applied to the subject firm offers an irrelevant outcome.

Valuation Model Type |

Label |

Equational form

|

|

| Key Value Driver (NOPLAT) | KVD (NOPLAT) | ||

|

|||

| Key Value Driver (FCF) | KVD (FCF) |

|

|

|

|||

| Free Cash Flow | FCF | ||

|

|||

| Economic Profit | ECON π | ||

|

|||

| Adjusted Present Value | APV | ||

|

|||

| Forward Market Multiple | FMM | ||

|

|||